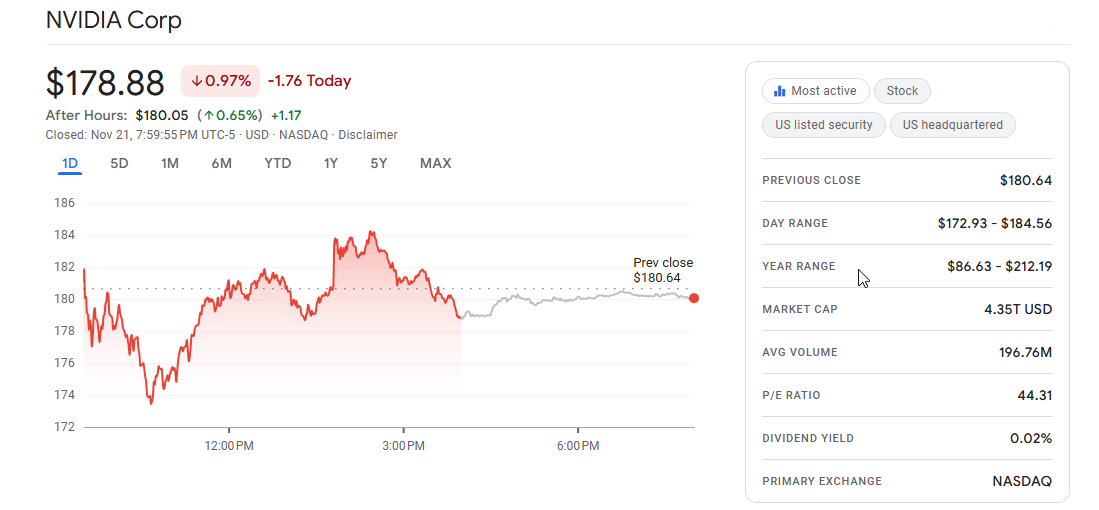

Nvidia (NASDAQ:NVDA) just dropped another blockbuster report, sparking new debates about the Nvidia AI Bubble. While CEO Jensen Huang was optimistic, the market reacted with fear.

But by the market close, those gains vanished.

This rollercoaster ride has left investors asking: If Nvidia is doing this well, why is the market so scared? As a developer watching the infrastructure build-out firsthand, and an analyst watching the charts, I believe we are seeing a disconnect between “Market Sentiment” and “Technical Reality.”

The Market Disconnect

With the Federal Reserve likely holding rates steady in December, the market is running out of short-term catalysts. The selling we are seeing isn’t because Nvidia failed; it’s because the market is “oversold” and looking for a reason to take profits before the holidays.

Some strategists are calling for an S&P 500 surge to 7,000, but that looks ambitious. We are witnessing a rare event: Excellent earnings reports resulting in negative stock movement. This usually signals that valuation concerns (fear of the bubble) are overpowering the actual fundamentals.

Why I Prefer a Correction Over a Crash

Ironically, this sell-off makes me more bullish on AI, not less.

- The Bubble Scenario: Markets go parabolic, valuations hit 100x P/E across the board, and then everything implodes (like the Dot-Com crash).

- The Current Scenario: We are seeing regular, healthy corrections. Fear is keeping valuations in check. This “Wall of Worry” prevents a true bubble from forming.

Jensen Huang’s “Vantage Point”

When asked about the bubble, Jensen Huang famously said, “From our perspective, we observe something entirely different.”

Why does he say that? Because he sees the order book.

From a technical standpoint, the demand for H100 and Blackwell chips is not slowing down. The “Bubble” argument assumes that companies will stop buying chips because they aren’t making money yet. But in the engineering world, we are seeing the opposite: infrastructure is the bottleneck, not demand.

Valuation Reality Check: Tesla vs. Amazon

Not all “Magnificent Seven” stocks are in the same boat. If you are hunting for bubbles, you have to look at the Price-to-Earnings (P/E) ratio.

- The Outlier: Tesla (TSLA) is trading at nearly 178x forward P/E. Unless their “Optimus” robot becomes a household item overnight, this valuation relies heavily on future dreams, not current reality.

- The Bargain: Amazon (AMZN) is trading at a reasonable 28x forward P/E. With their AWS dominance, Zoox robotaxis, and robotics integration, they are an AI powerhouse trading at a discount compared to Tesla.

The Bottom Line

Nvidia’s earnings proved the technology is working and the money is real. The market’s reaction proved that investors are skittish.

We may have to wait a few more quarters for the volatility to settle, but unless you are buying penny-stock AI startups with no revenue, the comparison to the “Dot-Com Crash” is exaggerated. The infrastructure is being built, and the correction we are seeing now is exactly what we need to sustain long-term growth.

Frequently Asked Questions (FAQ)

What is the “AI Bubble” fear?

It is the concern that AI stock prices (like Nvidia) have risen too high, too fast, and are driven by hype rather than actual future profits, potentially leading to a market crash.

Did Nvidia’s earnings prove the bubble is gone?

Not entirely. While the earnings were excellent, the market’s negative reaction suggests investors are still worried about high valuations and are taking profits early.

Is Tesla considered an AI Bubble stock?

With a P/E ratio over 170x, many analysts consider Tesla significantly overvalued compared to other tech giants like Amazon or Alphabet, making it riskier if growth slows down.

Should I sell my AI stocks during this correction?

If you hold high-quality infrastructure companies (like Nvidia, Microsoft, Amazon), corrections are often viewed as buying opportunities. However, highly speculative AI startups with no earnings are at higher risk.