Nvidia’s Fiscal Third-Quarter Earnings: Key Takeaways on AI Market Dynamics

Nvidia Q3 Earnings have once again demonstrated the company’s leadership in the AI hardware space with a strong report, showcasing its resilience and growth amidst market fluctuations.

Overview of Earnings Report

Nvidia reported fiscal third-quarter earnings that exceeded Wall Street expectations and provided an optimistic forecast for the upcoming quarter. The company’s stock experienced an uptick following the announcement, in addition to a boost for other AI-related stocks.

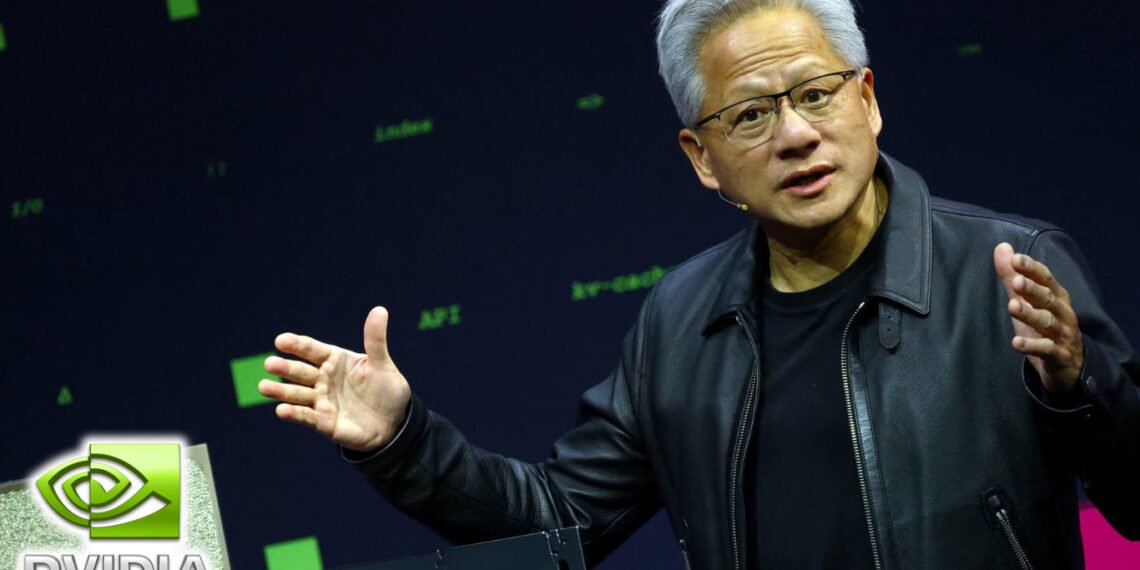

The report indicates that Nvidia continues to retain its dominant position in the AI chip market, particularly with graphics processing units (GPUs). CEO Jensen Huang expressed his strong confidence in future products during a call with analysts.

Expecting approximately $65 billion in sales for the current quarter, Nvidia is looking at an impressive 65% year-over-year growth.

Nvidia Rejects Bubble Talk

During the earnings call, Huang addressed concerns regarding an “AI bubble.” He articulated three distinct categories of AI applications that are driving the infrastructure investment boom.

He noted that traditional software is transitioning to GPU infrastructures, AI is generating new applications, and “agentic AI,” which operates independently of user input, is demanding more computing power. Huang suggested that investors should look beyond simple capital expenditures to understand the broader implications of the AI boom.

‘Half a Trillion’ Forecast is On Track

Last month, Huang disclosed that Nvidia had $500 billion in pending orders for AI chips during 2025 and 2026. The company affirmed that this forecast remains intact and could be bolstered by recent partnerships.

Investment analysts have emphasized that Nvidia’s backlog, which has not even accounted for all current orders, signifies long-term growth potential. Nvidia’s long-term outlook is significant given its influential role in the tech industry.

‘Insignificant’ China Orders

Nvidia has faced challenges in exporting its H20 chip to China due to geopolitical tensions. The anticipated sales from this market turned out to be minimal, with only $50 million recorded during the quarter.

Kress highlighted that the lack of substantial orders was surprising given earlier projections. Despite setbacks, Nvidia remains committed to engaging with both U.S. and Chinese governments to continue advocating for competitive positioning in the market.

Frequently Asked Questions

- 1. What were Nvidia’s earnings for the fiscal third quarter?

- Nvidia reported earnings that surpassed Wall Street expectations, indicating strong financial health.

- 2. What is Nvidia’s sales forecast for the upcoming quarter?

- Nvidia expects to generate approximately $65 billion in sales for the current quarter.

- 3. Did Nvidia address concerns about an AI bubble?

- Yes, CEO Jensen Huang dismissed concerns about an AI bubble, discussing the various forms of AI applications contributing to growth.

- 4. How significant are Nvidia’s orders from China?

- Current orders from China have been termed “insignificant,” with unexpected low sales figures reported.

- 5. What is the long-term outlook for Nvidia’s AI chip sales?

- Nvidia maintains a promising long-term outlook, anticipating $500 billion in orders for AI chips over the next few years.